Let me share with you these 10 Free Loan Amortization Schedule Templates (MS Excel) to allow you to print your Loan Amortization Schedule quickly.

Loan Amortization is a carefully spelled out payment schedule drawn on a loan and designed to be paid in parts to clear out such a loan. It involves making periodic payments, usually monthly, that ensure a fraction of the principal and the interest that the borrower will pay to clear out a loan within a specified period.

Usually, the amount of the principal is the same throughout payment. The interest charges depend on the amount of the principal remaining behind. It is clear, however, that both the principal and the interest are cleared concurrently, only that interest values reduce with time. This is because as more principal is paid overtime, less interest is due to the calculation of the balance of the principal.

Using Loan Amortization Schedule Templates:

The term amortization includes breaking a large amount of loan into small monthly installments that the borrower will pay on a mutually agreed date of each month. It is beneficial for auto loans, student loans, and other personal loans. It helps to generate the interest and principal for each monthly installment. It makes the work easier to understand for both parties and reduces the risk of future conflicts.

For easy analysis and clarity on how to Calculate a Loan Amortization Schedule, it is best to draw up a Loan Amortization Schedule table. This will check for any kind of mix-up in the repayment plan. But the most difficult part of this is how to prepare the Loan Amortization Plan. It will need the three details listed below to calculate each and everything accurately.

- The total amount of the loan.

- The percentage of interest upon which both parties are agreed.

- The duration in which the borrower will pay back the whole amount.

Loan Amortization is perfect when dealing with a car, mortgage, and/or housing loan.

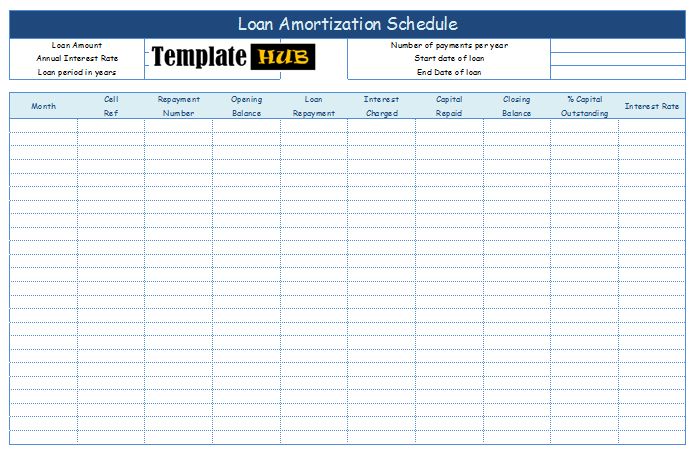

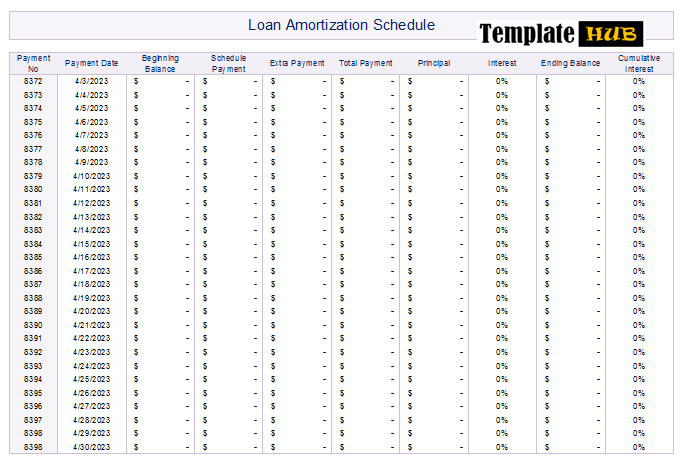

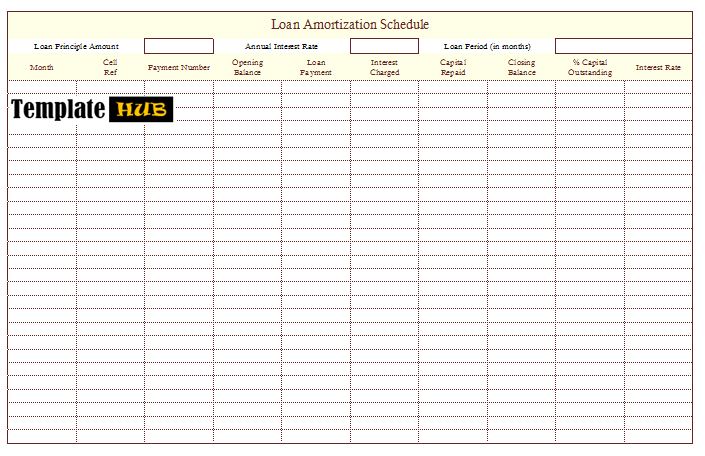

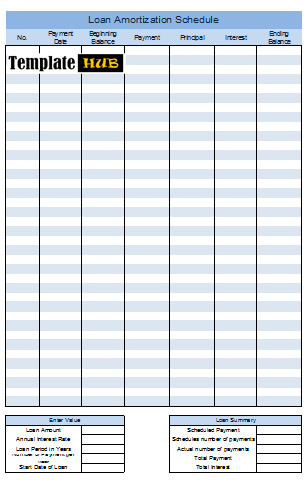

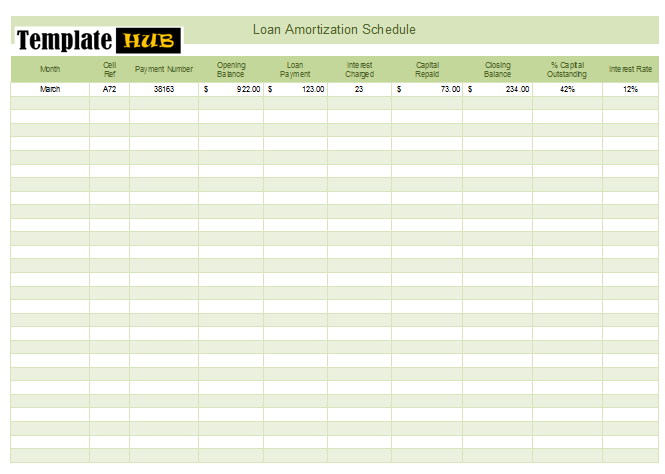

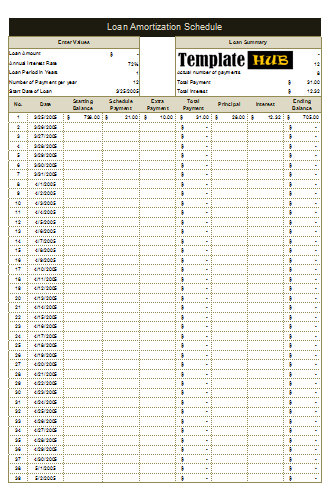

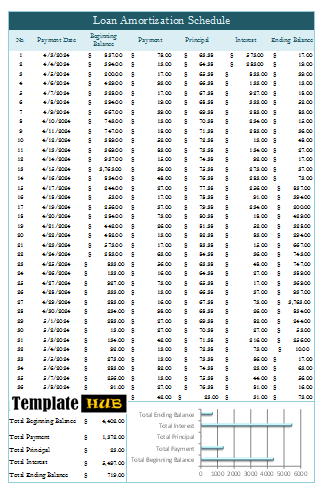

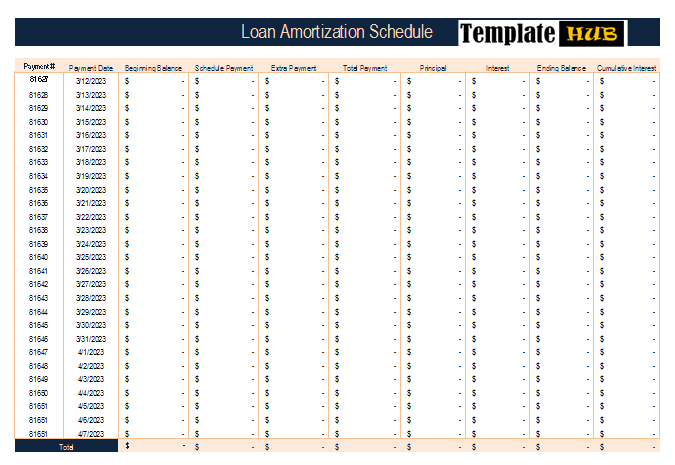

Free Loan Amortization Schedule Templates:

Here you can download our created Amortization Schedule Templates for your quick assistance.

How to Calculate Loan Amortization Schedule?

Nowadays, things are getting more and more expensive. The rates of homes and cars are going up day by day. We get a loan to buy our desired item as soon as possible. Paying a loan back is a hectic thing. Managing and calculating many things such as the interest, principal, monthly installment, and the remaining balance is difficult. To make it easy for yourself and the lender, you can use a loan amortization schedule template containing all the formulas to calculate everything accurately. Add your loan details, and the schedule is ready to use. It’s that easy. Using it can save a lot of time and effort.

The Loan Amortization Schedule is a table that shows how the borrower will pay back the amount of the loan over the period stipulated. Let’s assume that you are offered the sum of $200,000 as a housing loan to be repaid over 120 months (10 years) at a 5% interest rate. The implication is stated below:

Principal: $200,000.00

Monthly Repayment: $200,000 / 120 months

=$1,666,67

Monthly Interest: 5% of $200,000

= $10,000 (Annual)

$10,000.00/12 (first month)

Repayment time: 120 months

As I stated earlier, it is advisable to draw a Loan Amortization Schedule to put the many details in a clear format.

One peculiar change that will happen as the months progress is that the amount due for payment decreases every month, resulting in a reduction in the amount to be deducted as 5% monthly interest till the total loan is cleared.

For instance, the interest for the second month will be:

(Principal–total first-month payment): $200000 – ($1,666.67 + 833.3)

=$197,500.03

Interest for the second month: $197,500.03 – 5% divided by 12

= $822.92

The differences continue to change and decline as the payment made continues to grow, forcing down the value of the principal every month.

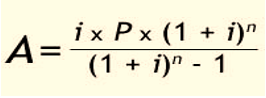

A more direct method is to use a formula where the needed values are imputed for each of the months till you have the 120 months stipulated completed. The formula is as stated below:

Where ‘A’ is the monthly payment. The ‘I’ is the varying monthly interest rate, ‘P’ is the loan initial amount, and ‘n’ denotes the total number of payments that the borrower will pay. You can input the values every month to derive the value payable.

Creating a loan amortization schedule is not a big deal. You have to find the right template according to your needs. There are many templates available on the internet that anyone can use. To help you out, we have listed some free and editable loan amortization schedule templates. Enter the loan amount, interest rate, duration, and other specific details. They will calculate the principal, interest amount, and everything in a well-managed way. All the templates are free and easily customizable. They are perfect for short-term and long-term loans.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.