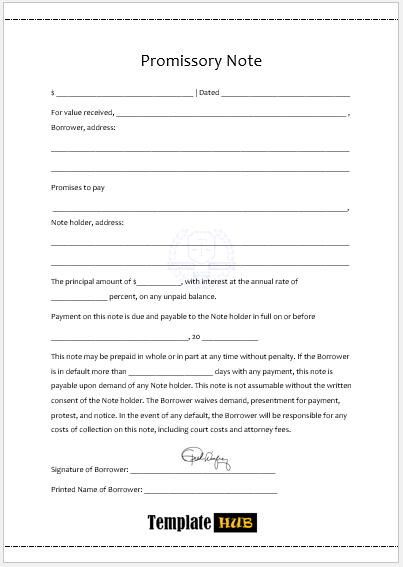

Download these 10 Free Promissory Note Templates in MS Word Format to study and prepare your own Promissory Note comprehensively.

As the name ‘Promissory Note’ suggests, it is writing that shows a promise to fulfill an obligation. Promissory Notes are agreements that specify how the borrower will pay back the amount of the loan. Further, a Promissory Note ideally and clearly contains all the terms and rules on how to pertain indebtedness to the note’s payee by the issuer of the Promissory Note. It is based on the amount, interest rate, maturity date, date and place of issuance, and signatures of the issuer. It also describes the possible and necessary steps to take any action if the borrower violates the terms or fails to repay the loan.

Why Promissory Notes?

Borrowing from family and friends to finance a business is one easy way. Start-ups have been raising capital to start their businesses over time. It is considered the fastest and easiest source of money available to young entrepreneurs and has been said to account for over 50% of all start-up businesses globally.

Though banks produce their own Promissory Notes, if you intend to approach an individual for this by yourself, you may need to develop your own by yourself. Further, Promissory Notes are very important when a loan agreement happens between individuals. Because it is easy to have misunderstandings without a concrete agreement. On several occasions, the borrower may assume the money is a gift due to his closeness with the lender.

In other situations, one party may decide to take the other for granted. Even more, it is possible that one party deliberately plays on the innocence of the other because of the flexibility. Ultimately, a Promissory Note closes the gaps to a possible mix-up of facts and gives the agreement a strong formal outlook.

According to Denny Freeman, a principal adviser with Darda Financial Services in Winston-Salem, North Carolina, “A Promissory Note means that by nature you have the money to make payments on the loans”. Further, warned that if your cash flow is uneven, you should check for other alternatives like an equity agreement.

Free Promissory Note Templates:

Here are previews and download links for these free Promissory Note Templates,

Writing a Professional Promissory Note:

First, it is important to treat personal loans as a formal business transaction. Meanwhile, this will enable you to give it the attention it demands. It is advisable to sit down with the other parties and agree on the details of the contract, which will spell out the conditions in the Promissory Note.

The names of the two parties involved should be written on the agreement, clearly stating who the borrower and the lender are. The date the loan is being taken and the amount should be included. The repayment plan, the period of repayment, and the interest charged should be included. Sometimes, collateral is involved. Therefore, the Promissory Note should clearly state what the collateral is and the point at which it is due for return.

You should clearly include all the agreements on the Promissory Note. In short, when the amount involved in the contract is substantial enough, there may be a need to involve a lawyer. However, this will help to have a legal perspective and input on the agreement.

Promissory Note Investment Plan:

Let’s see how we can use Promissory Notes for an Investment that can yield a good profit in the end. Further, I assume that you wish to invest in Promissory Notes guaranteed by Real Estate properties in your nearby areas. However, such property should be within 100 to 120 Km from your location, otherwise, it will be considered an investment risk.

Let’s review the investment proposal and possible outcomes to guide your decision.

- Actual Amount You are Planning to Invest (be specific)

- How much money do you feel comfortable spending on each note? 20%, 40%, 60%, 80%.

- Expected Period of time for your financial investment? 6 months, 12 months, 24 months, 60 months, and 120 months.

- The way you will be discovering appropriate promissory notes? Promissory note specialist, market, network, Bing, private contacts.

- Exactly how will I go about identifying the standard of the note? Promissory note expert, lawyer, CPA, monetary adviser.

- Exactly how will I get about determining if we would like to be a minority investor-10%, 40%, etc. – on a particular note?

- Character references for the other minority people, when you look at the note, credit references, and credit histories of the other minority, note investors talk to a promissory note specialist.

- Who is likely to be accountable for maintaining the note? Which is likely to collect the monthly payments, verify that hazard insurance is in place, verify the residential property fees, and deliver complete year-end income taxation reports to the minority buyers and also to the borrower?

In a Nutshell:

Do you wish to hire a professional promissory note servicing company, one of many other minority buyers? Further, this can help you in situations where problems arise associated with the debtor or among the minority people. Resolution can be by vote, according to the percentage of ownership. By vote based on one vote per investor, by a prior written agreement signed by the specific people, or by conversation, as issues arise, on a case-by-case basis.

Plan as to how well you make decisions if additional cash is necessary to spend money for appropriate fees, and accounting charges, or to spend for outstanding residential property taxes and hazard insurance coverage. By vote, based on a portion of ownership, by a prior written arrangement signed by the individual investors, by discussion, as problems occur, on a case-by-case basis.

To be able to be successful at everything, great preparation is essential. Tailor the plan to your individual capabilities, needs, and objectives. Don’t you need to “reinvent the wheel” yourself whenever it has currently already been devised and mastered? Meanwhile, gain benefit from the mistakes that other individuals have already made, and that they’ve learned from. Further, there isn’t any reason for one to re-make expensive blunders. However, you can easily and really have an expert help you avoid typical blunders. However, engage an honest, seasoned promissory note specialist to help make the key decisions.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.