Download 10+ Salary Slip Templates for Free (Excel and Word) to help you prepare your Salary Slip easily.

A Salary Slip, commonly referred to as a pay slip is an important and common official document. Whether you have a big company or a small establishment, it’s unlikely that you won’t issue salary slips to your employees. In most companies, when salary is transferred to employees’ accounts, they also get this slip from HR or finance department and it includes everything from their basic salary to additional benefits and compensations to tax deductions. Usually, a salary slip is sent via email at the beginning of each month but some companies also send it printed on company letterhead. In many organizations and companies, employee salaries are directly deposited into their bank accounts.

Practical uses of Salary Slip:

There are basically dozens of benefits and practical uses of a salary slip both from the aspect of the employer and the employee. When we talk about the use of a salary slip from the point of view of the employer, this slip helps them share the details of what they paid to each employee. If the worker has any concerns or finds a mistake in the slip, he can contact the relevant department for correction. If there is no claim, it’s understood that the slip was correct and later the employee can’t make any claims. The biggest concern of employers here is to verify the account number to which the salary is transferred. Unless you are a manual worker, your salary is definitely transferred to your bank account which means you need to check and verify if the employer has your correct bank account.

Now talking from the perspective of the employee, there are many uses but some of these are more important. For instance, when an employee gets a salary slip, he can quickly see what he earned this month and if it’s correct as per the salary offered by the employer. The next use of a salary slip would be to check tax deductions as this slip indicates all the deductions separately so it’s very easy to check and see what you will be putting in your tax return form.

When you get an offer from another company and you want to switch jobs, you should get the salary slip from both companies and compare them. This will give you an exact idea of what your net salary is and will be, what additional benefits you are getting with your current employer what you will get with the new company, and most importantly, how much tax is deducted in both companies. This way you can see that even if the net salary is higher at the new company, there will be fewer additional benefits leading to comparatively less income.

10 Free New Salary Slip Templates (Exclusive)

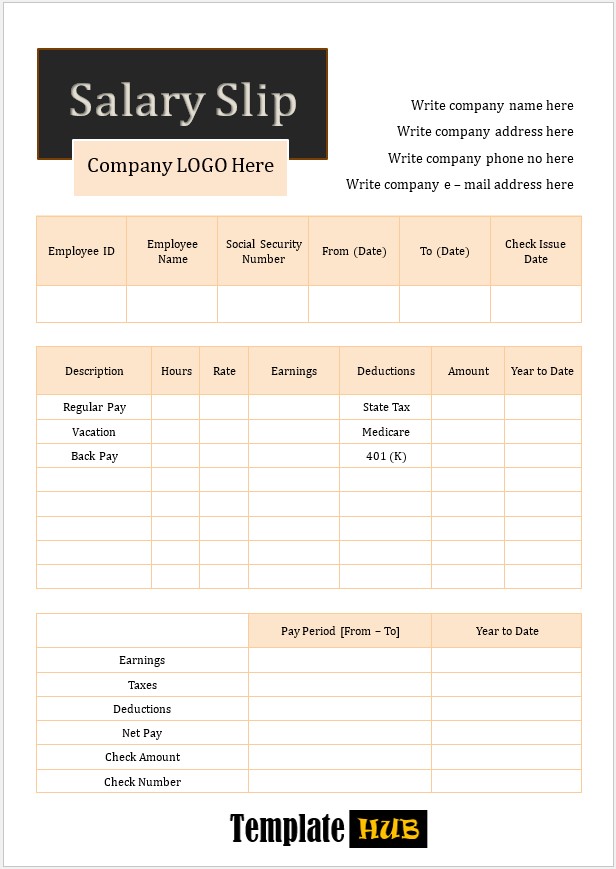

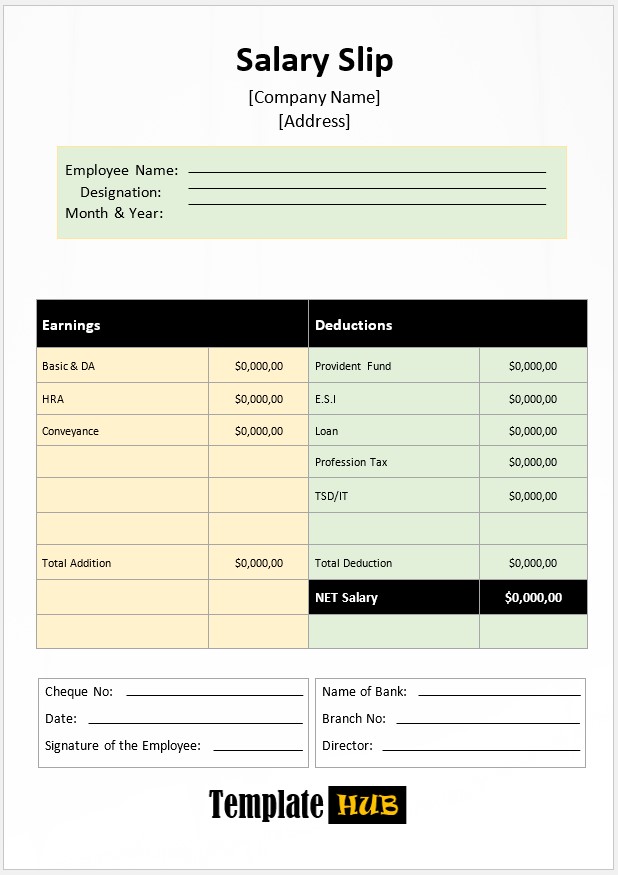

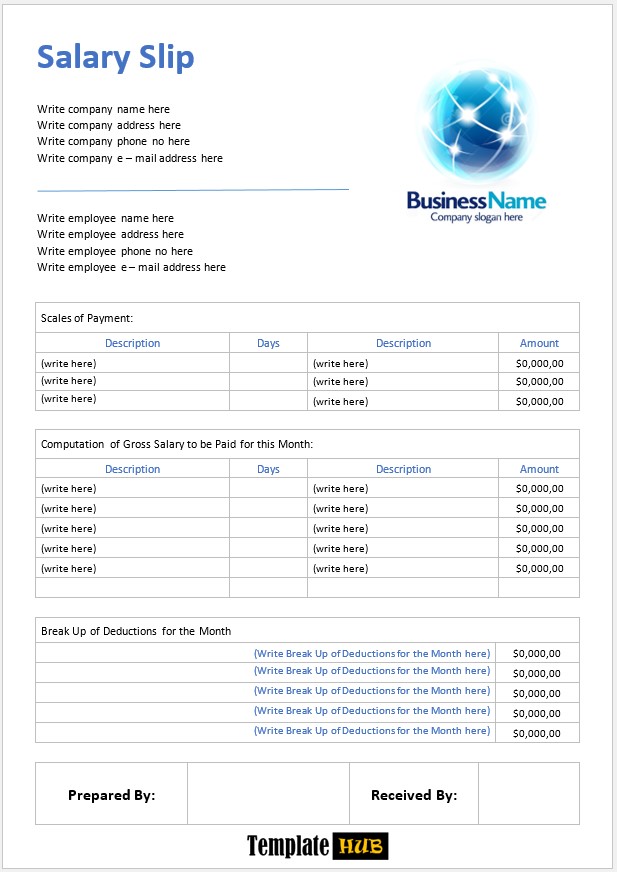

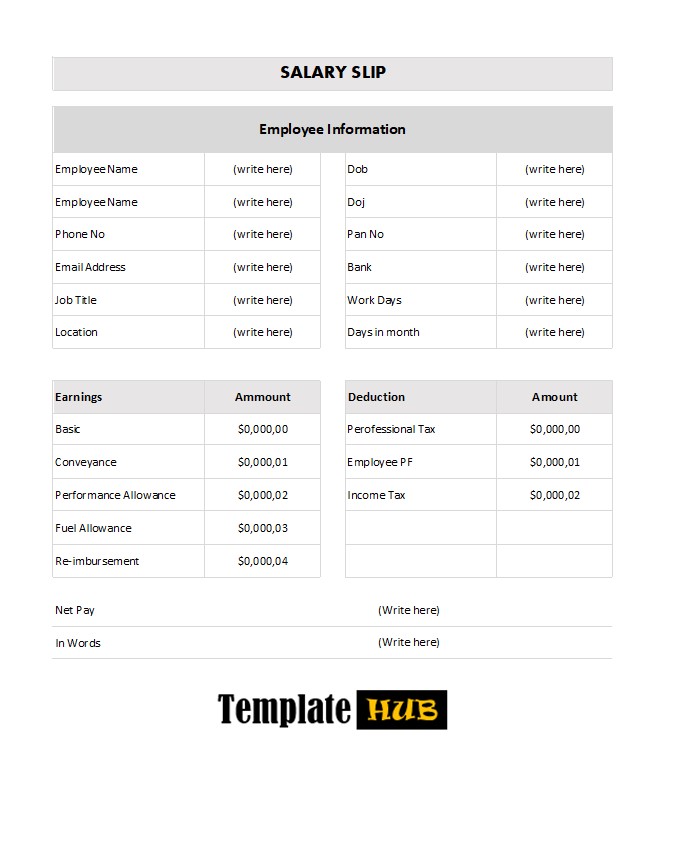

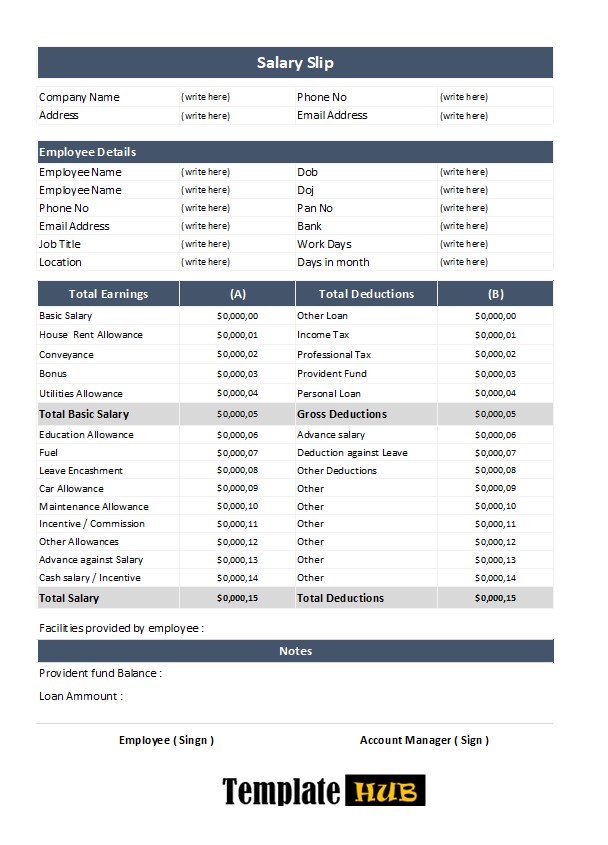

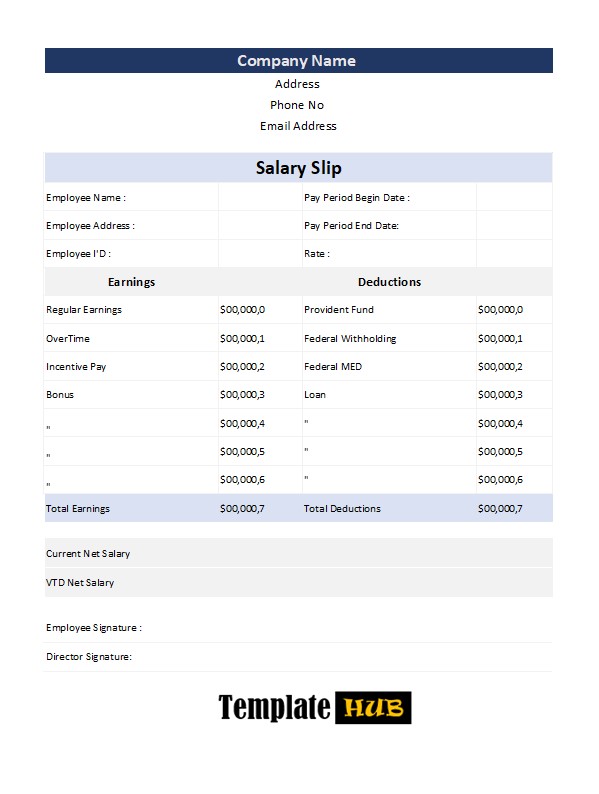

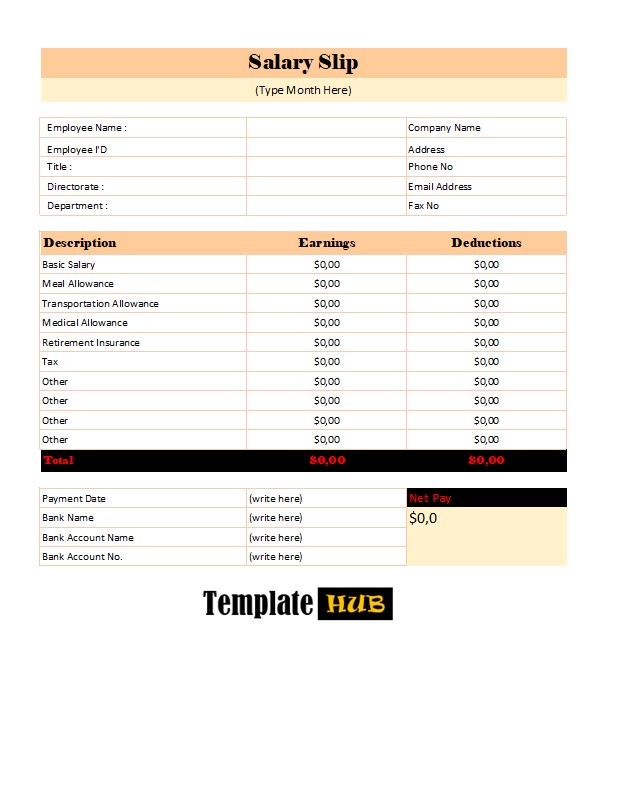

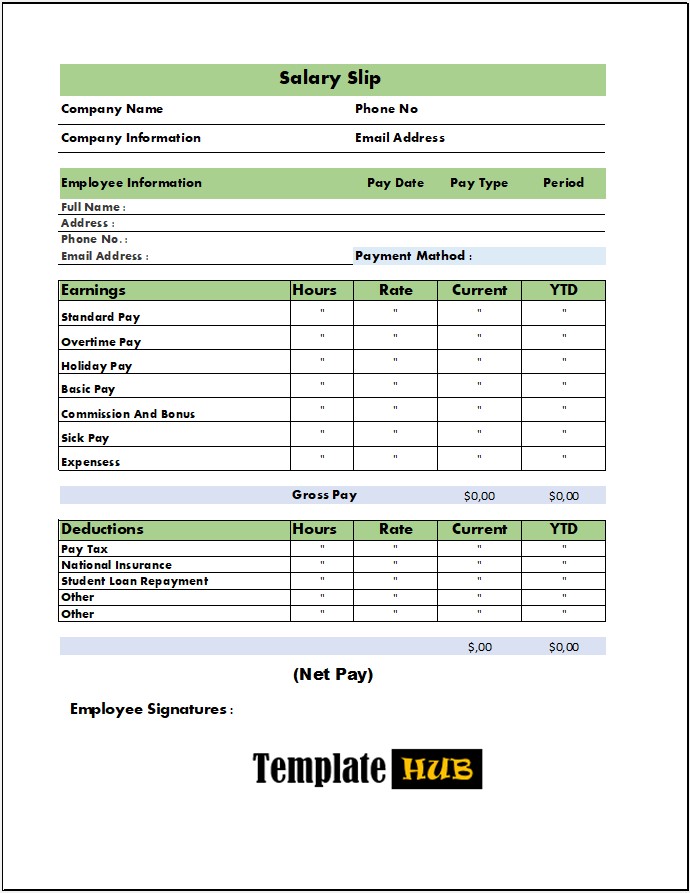

Here are previews and download links for these 10 New Salary Slip Templates,

Key Elements of a Salary Slip:

Here are the key elements to consider while preparing a professional Salary Slip,

Basics of the Salary Slip:

A salary slip is a very common and basic document that companies use on a regular basis. Yet, there are many formats of salary slips that don’t show all the required information. A salary slip is considered complete only if it has all the necessary details. It starts with the name of the company, the date on which the slip is created, and the month for which it is created. The next thing would be to add the number of days i.e. 30 or 31. After that, there comes the section where employee-related details are added including; the name and company code of the employee, his designation and department, and the name of his bank along with his account number. While creating a salary slip, make sure not to skip any of these details.

Details of Net Salary:

This is a pretty standard part of the salary slip as it includes the total earned salary of an employee. Here it’s mandatory to mention salary both in numbers and words. When you get your salary slip, the one thing you must do is check if your basic salary is correctly written on the slip. In most companies, benefits and additional compensations are calculated on the basic salary which means the more the basic salary the more benefits you will get with it.

Details of Compensations and Deductions:

In a salary slip, the section below net salary is the biggest section. This is the part that includes everything in between what the employee earned and what he is actually getting i.e. net income of an employee is $5,000 but after all deductions, he gets only $4,700. This part of compensations and deductions will explain what is added or deducted. It starts with the addition of benefits i.e. house rent, big city allowance, travel allowance, medical compensation, and any other type of extra amount that is other than the net salary. After that, there is the part that gives you details of all the deductions. This will include; tax deduction at source, old age benefit deduction, insurance fund, and provident fund. These and many others are the common deductions that are made by the employer with the consent of the employee.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.