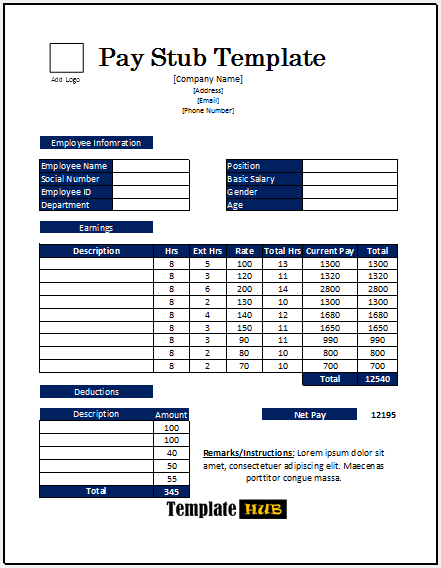

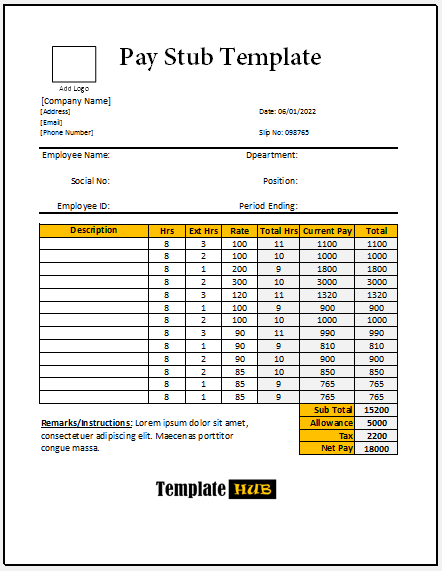

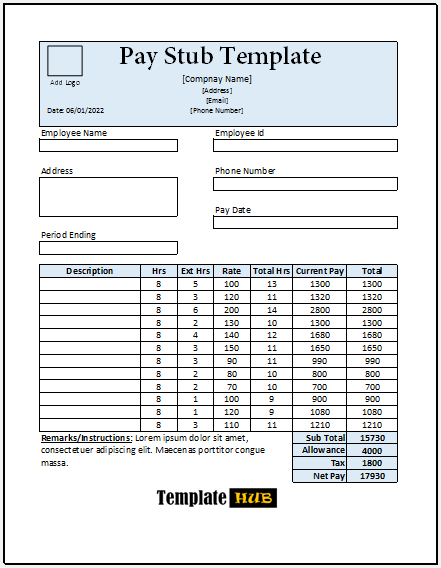

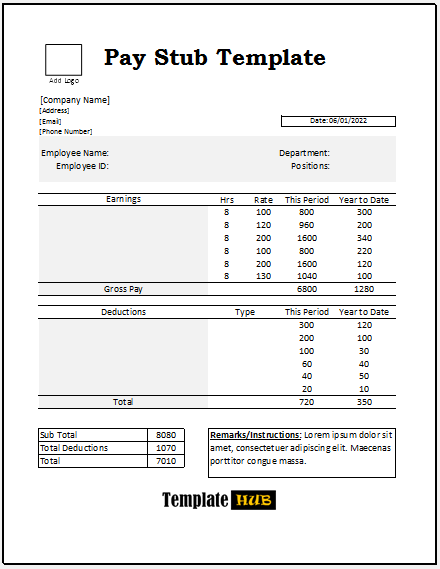

Download these 10 Free Pay Stub Templates in MS Excel Format to assist you in the process of creating your own Pay Stub easily.

As an employer, it’s important for you to understand the basics of pay stubs. Because it’s possible to miss a portion easily, but first, you should get an idea of what a pay stub is and what role it plays in any company or organization. A pay stub is a document that you issue with the paycheck to the employees. This document includes all the deductions and additions to the gross payment or income of the employee. It’s more than common that employees don’t get the exact salary they were promised during the time of hiring and it happens because there is the most common deduction of tax on the income of each employee along with the deduction for insurance, medical and then there is the addition of bonuses, commissions, and travel compensations.

This means if the record shows that the salary of an employee is $5,000, he won’t get exactly $5,000 every month but it can be less or above depending on the number of deductions and additions, and all these details are provided to employees on their pay stub document. When companies use pay stubs on a weekly or monthly basis for dozens or even hundreds of employees, it makes sense to create a template or design and use it over and over.

Free Pay Stub Templates:

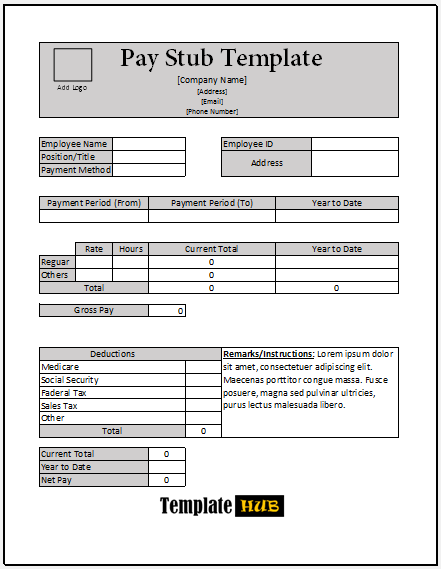

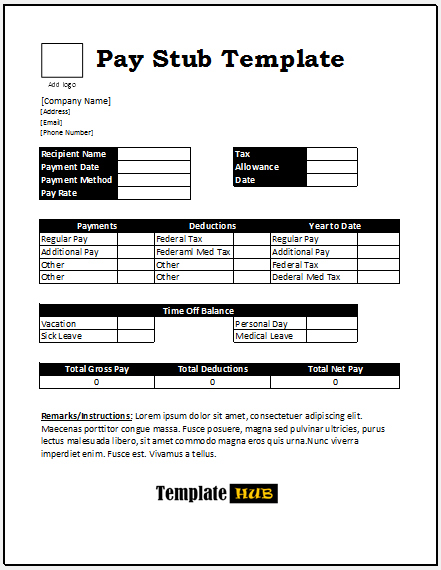

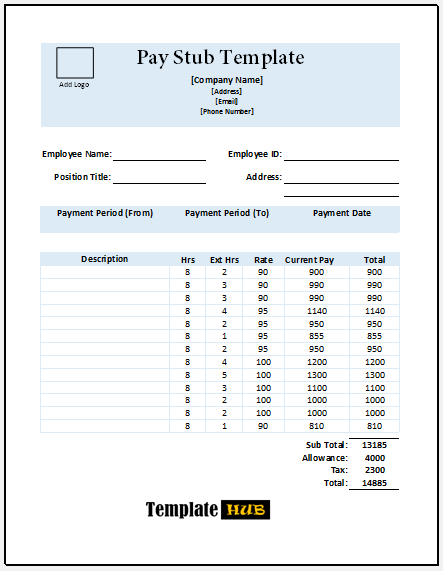

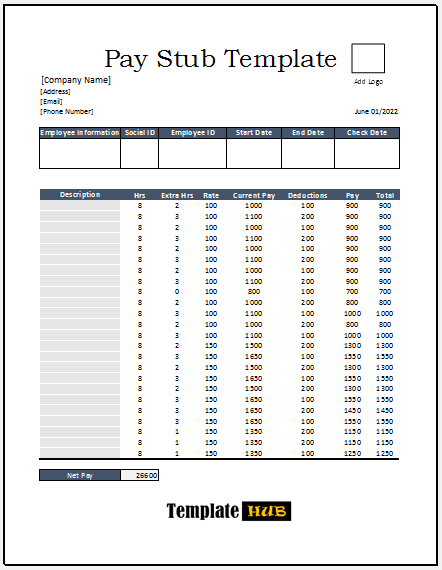

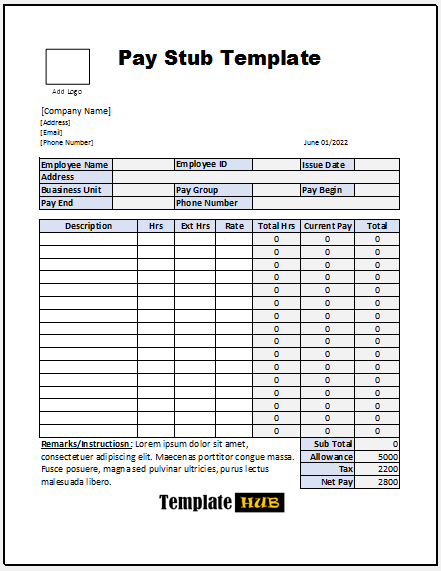

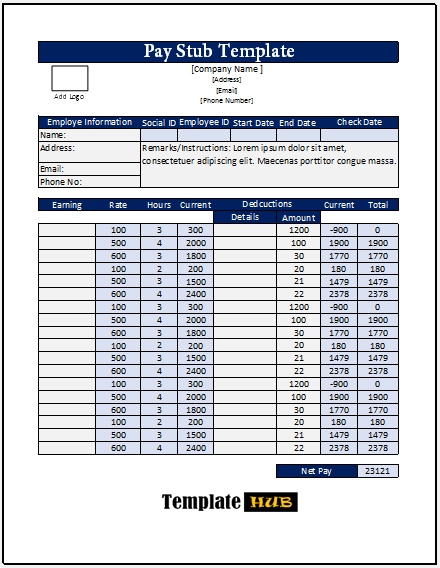

Here are previews and download links for these free Pay Stub Templates in MS Word format,

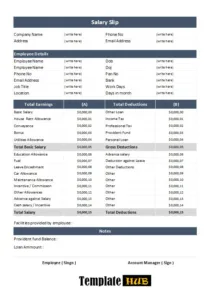

Key Elements in a Pay Stub Template:

Below, we have listed some key elements of a pay stub that you should keep in mind while creating a pay stub.

- Full name and address of the company.

- Name and details of the employer.

- Name and details of the employee.

- The time period or duration of the payment.

- The date on which payment was made.

- Gross income of the employee, including overtime.

- Additional income, i.e. commission, bonus, etc.

- Pre-tax and post-tax deductions.

- Net payment of the employee.

- Signature of the authorized person.

Uses and Importance of Pay Stub Templates:

Let’s face the fact that no one wants to do a boring job. Even if a secretary or assistant is hired to maintain office files and records, he ends up getting bored doing the same tasks again and again and somehow comes up with an innovative approach to do the regular job with enjoyment and excitement. The same thing goes for the payroll department, which prepares paychecks and pay stubs or income statements for each employee in the company and this doesn’t happen once a month or year but weekly or even daily for daily wages workers.

After understanding what information you should add to a pay stub, it’s important to maintain the same information and design or layout of the document. If a document is used this frequently, it’s better to create a design, save it, and use it every time a pay stub is prepared. This template includes the basic portions, i.e. name of the employee, duration of the income, the date on which the pay stub is prepared, gross salary of an employee, and net salary at the end after deductions and additions.

With this pay stub template, payroll employees can ensure not miss an important portion because they don’t need to create the document from scratch each time. Instead, they can just open the template file, include the details of each employee one by one, and then they can print or send it via email to all employees on the company’s payroll. One important aspect of a pay stub is that this is a legal document, which means most states and countries bound employers to issue pay stub documents regularly to reduce the risk of future disputes.

A single mistake or error can lead to a big problem so it’s crucial that the payroll department prepares to pay stub documents as it will allow them to go through the details of each employee and ensure there is no mistake i.e. wrong percentage of tax deduction or addition of less than calculated commission.

Most Common Pay Stub Templates:

- Corporate pay stub template.

- Professional pay stub template.

- Simple pay stub template.

- Generic pay stub template.

- Restaurant pay stub template.

- Daily wages pay stub template.

- Weekly pay stub template.

- Monthly pay stub template.

- Temporary employee pay stub template.

- Permanent employee pay stub template.

By using a pay stub template, you can easily form a pay stub in a matter of minutes. Because it saves you from spending your time on the design and the structure of the pay stub. Meanwhile, a template provides you with a pre-designed structure and layout. Everything is well-aligned and organized in a well-managed way. You just have to add your details to the template and your document will be ready in a few minutes.

Some templates require you to do the calculations by yourself, but some templates contain the formulas to calculate each and everything precisely. To help you out, we have listed some free and high-quality pay stub templates. These templates are editable and customizable. Our templates are available in MS Excel Format. These templates contain formulas to perform all the calculations automatically. You just have to add your details to the specified spaces.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.