It is very important for individuals and especially for organizations and corporations to have updated and latest details of their bank accounts. Not only this is important for taxation and revenue filing purposes, but it’s essential to have the exact amount of cash in front of you before you issue a check. It bounces because of insufficient funds. A common problem that organizations face every day is that they issue a check to a vendor and the receiver often doesn’t cash it out on the same date.

This means that the money in the account appears to be more than what it should be. To tackle this and many other relevant problems, organizations prefer a checkbook register. This register is used to record each transaction, whether it’s credit or debit, cash or check. This way, the register or account holder knows exactly how many funds are there in the account without contacting the bank for an official account statement. Below, we have listed some key elements of a checkbook register to help you out.

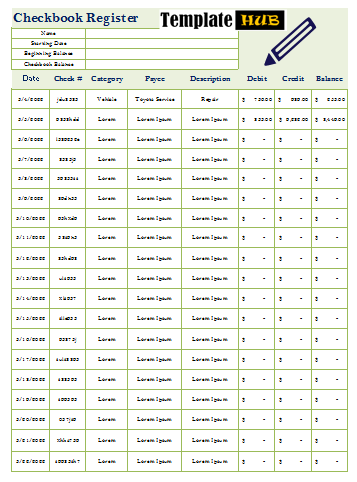

10 Free Checkbook Register Templates:

Here we have listed a simple checkbook register template in MS Excel Format to help you out. This template contains columns to record all the information in a well-managed way. You can easily edit and customize this template according to your needs.

Key Elements of Checkbook Registers:

- The date on which the check is made:

The first thing that you need to mention on your checkbook register is the date on which you issue a check. In most cases, this is not the date on which the receiver will withdraw money from your account. So, you need to show the exact date of issuing the check on the register. - A serial number on the check:

Each check in your checkbook has a unique serial number, which is also known as the check number. You need to enter this number in the register as well. In the future, if there is any problem or legal dispute, you can track the check and its recipient with the help of the check number. - Bank and account details:

For an individual, it might be uncommon to have multiple bank accounts, but for corporations and organizations, it’s very common. Each bank account comes with its perks and advantages. Companies tend to hold multiple accounts for their ease of financial transactions. If that’s the case with you, you need to mention accurate bank name and account details, i.e. current, savings, salary, etc in front of each check transaction. - Transaction description:

Then comes one of the important parts of the checkbook register. In front of each transaction or issued check, you need to clearly describe the purpose of the check or payment. Add the name of the receiver and his or her company name. This way you can easily track payment and check the name of the recipient, and this will also help you to describe the purpose of each transaction for taxation purposes. - Amount of payment:

This column is fairly simple as it includes the total amount of money that you put on the check. Mentioning this figure in numbers is fairly common, but in some cases, the registered holder is also required to mention the amount in words as well. - Deposit amount:

A checkbook register is not just for the checks that you issue, but it also includes the details of the cash that you receive in your bank account. This way, you can say that this register provides up-to-date details of your bank account with the exact amount that the account holds to date. When you receive or deposit any money into your bank account, add its details to the register as well. - Transaction fees or bank charges:

When you make a payment or issue a check, there are often some bank charges that the bank deducts from your account in return for the fund’s transfer or cash issuance. If not recorded in the checkbook register properly, can lead to misguided account details, i.e. account holds less than what you expect. To ensure that the checkbook register shows the exact amount of cash in your account, you need to check with the bank and confirm transaction charges. Next time you record a credit or deposit transaction on the register, mention the transaction fees as well. - Opening and closing balance:

In the end, there is nothing left but the opening and closing balance of the account after each transaction. When you enter a new transaction on the register, always mention the closing balance of the account. This same amount will serve as the opening account when you add a new transaction next time.

Creating a checkbook register is not a big deal. Nowadays, if you want to create a document, then you need to select the right template. A template contains a pre-designed structure and flow in which you can add your details to form your document in a matter of minutes. Many templates are available on the internet that you can download and use. To help you out, we have posted some free professional checkbook register templates that anyone can use according to their need. These all templates are easily editable and customizable.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.