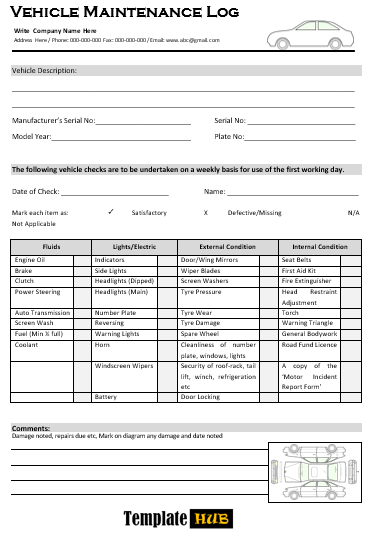

Download these 10 Free Vehicle Maintenance Log Templates to assist you in preparing your Vehicle Log easily and effectively.

A vehicle Log is a document that shows the record of vehicle usage daily. Vehicle Log is most important in corporate companies and organizations. At these places, employees are responsible for handling the vehicle during working hours. This article will focus on the importance of the Vehicle Log document.

The Vehicle Log will indicate the name and employee number of the driver who will be using the vehicle on that particular day. This is very important in that case you can hold them accountable for any malfunctioning or damage to the vehicle. You can keep track of your company drivers to make sure they do not misuse the vehicle. Because the driver will fill in the condition of the vehicle in the morning and the condition of the vehicle in the evening when he will be returning it to the office. This will ensure that every driver takes good care of the vehicle.

Importance of Vehicle Maintenance Log:

It is also very important to keep an accurate Vehicle Maintenance Log. It will help you to know the maintenance and repair costs of the vehicle. At the end of the month, you can calculate the total maintenance cost of the vehicle. If the company owns more than one vehicle, you can also compare the logs and see if there are vehicles with higher maintenance costs than others. This way, you will find out the cause and handle it accordingly. Looking at the Vehicle Log, you can also tell if the company is incurring any unnecessary repair costs so you can adjust them.

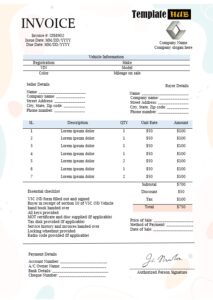

Free Vehicle Maintenance Log Templates:

Download these free Maintenance Log Templates for Vehicle Management.

Vehicle Log will also help you in adding the vehicle resale value. When you sell the vehicle, the buyer will get clear information on how well the vehicle was taken care of and also see the maintenance cost that will prove the value of the vehicle at the time you will be selling. It is also important to show the buyer that the vehicle is in good condition. By looking at the Vehicle Log, one can tell if the vehicle has had any major problems and if not. It means that the vehicle is in good shape.

Key Aspects of Vehicle Maintenance Log:

A vehicle Log is also important when a person has been provided with a car by their employer. Because it is required to maintain a log for FBT purposes. Over the last few years, the tax office has started a motor vehicle registry data matching program to assess the overall taxation submission of individuals and businesses involved in buying and selling vehicles. The program involves the tax office requesting details from the state-owner and territory motor vehicle registering authorities where a vehicle has been transferred or is newly registered and the purchase price.

The purpose of the Vehicle Logbook is to determine the business use percentage of the vehicle. There is kept all the records about the vehicle like the business use percentages of income tax. If the income tax is greater, the deductions may be claimed for work-related car expenses. There is also the record of FBT. If the business use percentage is under FBT and is lesser than the amount of FBT, then it is payable for car benefits.

Vehicle Maintenance Log – Legal Aspects:

Income tax and FBT are two main purposes that are required for the maintaining of the Vehicle Logbook. There is a little bit of difference between the record book of FBT and income tax. FBT record includes and applies to the relevant FBT year and the income tax Vehicle Logbook is applied naturally to an income year that is ending in June.

The vehicle Logbook is valid for five years. After the end of the fifth year, a new Vehicle Log book will need to keep all the records. A book must be kept for the record of at least a continuous 12-week period. The year in which you start your Log book is known as the logbook year. Your Vehicle Log book must reflect the business use of the vehicle. This task can be tricky.

Your log book must contain the period that begins and ends. It also must contain the car’s odometer readings at the start and end. Your Vehicle Log book should contain the number of kilometers traveled for each journey. When you put the record of your vehicle’s journeys, it must contain the journey’s start and finishing time, odometer readings at the start and end of the journey, and the number of kilometers traveled for your journey. The data that you have entered must describe the purpose of the journey. So it can be classified as a business journey. Your private travels are not required to enter into your record, but if you enter these journeys, it may help with calculations. Mostly odometer records are kept as a part of the Vehicle Logbook, which describes the starting and closing records for the relevant period.

Using Vehicle Maintenance Log Templates:

Vehicle Log will also be helpful to the company when calculating the fuel cost. Each vehicle will show the cost of fuel each vehicle consumes daily. This way you can tell if the vehicle is consuming more fuel than it should; if this is the case then it means the vehicle needs to be checked. When a vehicle is consuming more fuel it could be a sign of a major problem. So the earlier to take it to the mechanic, the better; a small problem can become a big issue if not handled at an early stage.

It is also very important to keep a Vehicle Log as it will help you prevent your employees from using the vehicle for purposes other than business purposes. With an accurate Vehicle Log, you can keep a record of the business kilometers traveled and the personal kilometers. So when an employee records more personal kilometers than allocated, that means they are not using the vehicle for business purposes.

The Vehicle Log is an important piece of tax substantiation for those people who use their vehicles in the course of performing their duties. Here are two main causes for which a Vehicle Log is required. Vehicle Log is important when a person is claiming a deduction in the personal tax return for work-related car expenses using the Vehicle Log book method.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.